4 401k match calculator

We automatically distribute your savings optimally among different retirement accounts. Then do a substantially equal distribution from the IRA.

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Since most personal loans come with fees andor insurance the end cost for them can actually be higher than advertised.

. When you have a student loan balance we understand you want to get rid of your student loan as soon as possible. 100 and 6 respectivelyEmployer Match Annually box selected 10Years to Fund 401k 11Average Annual Interest Rate Earned Annually box selected Press View Schedule. Step 5 Determine whether the contributions are made at the start or the end of the period.

Your employer match is 100 up to a maximum of 4. A 401k match is money your employer contributes to your 401k. Not based on your username or email address.

Even 2 percent more from your pay could make a big difference. One of the biggest perks of a 401k plan is that employers have the option to match your contributions to your account up to a certain point. Roth IRA plus 15 of salary.

1 With employer match Max employer will match. Smarter investors are here. Blue Origin rocket malfunction triggers dramatic abort.

But the bottom line is you CAN tap 401k IRA money before 59 12 without. Must contain at least 4 different symbols. This becomes especially appealing when your company offers a 401k employer matchHowever some plans restrict highly compensated employees HCEs from making the maximum contribution.

You can contribute up to 26000 if youre age 50 or older. Department of Education announced an extension of the pause on federal student loan repayment interest and collections through August 31 2022. Max employer will match plus Roth IRA.

Check it out on the IRS web site. This calculator is intended for use by US. Value is so much more than a price tag.

Available to US-based employees Change location. A 401k is an employer-sponsored tax-advantaged retirement plan. Contribution percentages that are too low or too high may not take full advantage of employer matches.

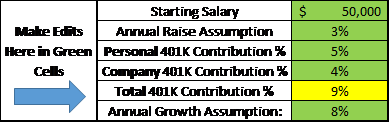

One formula is based on your age another is like an annuity and I forget off the top of my head what the 3rd formula is. Your current before-tax 401k plan contribution is 5 per year. We assume you will live to 95.

With this key job benefit your employer adds to the money you save boosting your 401k account over the long term. 401k health insurance HSA etc. 40 Former All Around Employee in South San Francisco CA California One of the best benefits I had was from Costco they had 401k healthcare I only ever paid 20 for copays dental and vision and they are pretty generous in terms of raise every 1000 hours and free acupuncture 20x a.

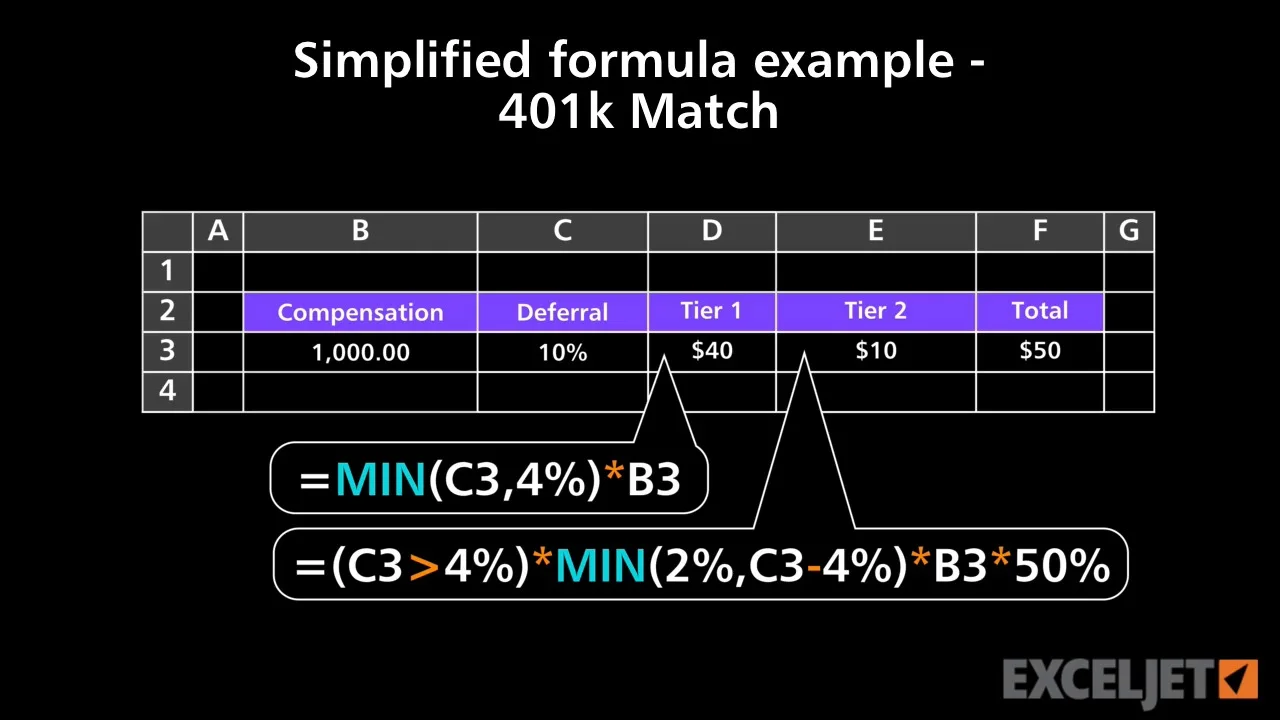

At least 1 number 1 uppercase and 1 lowercase letter. You fund this account by contributing a set percentage of your paycheck into the account. Use the Additional Match fields if your employer offers a bi-level match such as 100 percent up to the.

One of the benefits that make tax-deferred retirement accounts like 401k plans so attractively is their high contribution limits. Roth IRA plus 10 of salary. A 401k account is an easy and effective way to save and earn tax deferred dollars for retirement.

Some companies match contributions up to a certain percentage. If the percentage is too high contributions may reach the IRS. We indicated that the employees 401k contribution was 100 per month and the employer match was also 100 per month for a total annual contribution of 2400.

Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account. Those may give you additional room to keep you below 4 x. A case could be made for at least contributing as much as possible towards what an employer will match for a 401k.

Since you mentioned self-employment taxes if you continue self-employment in 2018 keep in mind the ACA health insurance premiums not covered by the tax credit plus your Medicare premiums in the 2nd half of 2018 are deductible above the line. What are Personal Loans. Thats quite an accumulation of savings over 37 years.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. It will however be deposited into a traditional 401k for you because of. It can also be used to help fill steps 3 and 4 of a W-4 form.

Fist off when you retire roll the 401k to an IRA. 624 employees reported this benefit. Applying these figures to this calculator returns a before-tax total value of your 401k retirement account of 795517 in year 37 before you retire.

But did you know that paying off your student loans quickly could possibly. For 2020 and 2021 the annual contribution limit for a 401k is 19500. You provide a mandatory match of 100 dollar for dollar on contributions of up to 4 you can match up to 6 of compensation contributed by employees.

We stop the analysis there regardless of your spouses age. Youve got a great employer who matches your 401k contribution 200. You have to stay below 4 x 12060 in 2018.

Deductions not withheld. Over 90 of employers that offer a 401k plan also kick in a company match. The calculator takes all of these variables into account when determining the real annual percentage rate or APR for the loan.

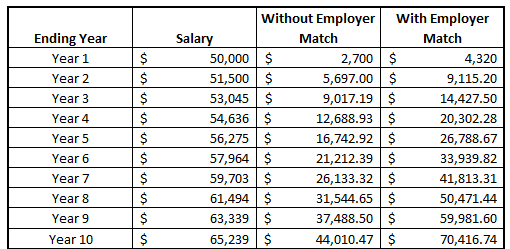

On Wednesday April 6 2022 the US. You will have about 171725 in your 401k in 10 years assuming all variables are met of course. We assume that the contribution limits for your retirement accounts increase with inflation.

1 No employer match 5 of salary. If your employer offers a 401k match and you contribute to a Roth 401k you are still eligible to receive the match. You commit to a mandatory contribution of at least 3 of employee salaries to all who meet the plans eligibility rules regardless of whether or not the.

Using this real APR for loan comparisons is most likely to be more precise. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Commission-free trades are everywhere.

Dec 03 2014 KPMG 401K Plan. Step 7 Use the formula discussed above to calculate the maturity amount of the 401k. What does 401k match look like at BCG.

Scientists found that a 45 billion-year-old collision between an asteroid and dwarf planet is the likely source of the rare gem. Roth IRA plus annual 401k maximum.

401k Contribution Calculator Step By Step Guide With Examples

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

401 K Plan What Is A 401 K And How Does It Work

Customizable 401k Calculator And Retirement Analysis Template

401k Contribution Calculator Step By Step Guide With Examples

Take Control Of Your Own Destiny With This 401k Employer Match Calculator

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

401k Contribution Calculator Step By Step Guide With Examples

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

A Retirement Calculator Calculates How Much You Need To Save To Ensure A Smooth And Comfortable R Retirement Calculator Financial Calculator Financial Planning

Free 401k Calculator For Excel Calculate Your 401k Savings

How To Choose The Right 401k Contribution Rate Budget Like A Lady Investing For Retirement Investing Money Investing

Excel Tutorial Simplified Formula Example 401k Match

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Doing The Math On Your 401 K Match Sep 29 2000